For companies, how to deduct your depreciation?

As a sole trader or company director, it is essential that you optimize your company’s tax situation by using deductions on your taxable income.

Depreciation allows you to reduce your taxes by taking into account the loss in value of some of your assets and investments.

What is depreciation?

First of all, it is important to understand what the term “depreciation” refers to. It is an accounting concept that makes it possible to recognize the depreciation of an asset (goods and rights of the company), due to its use.

The depreciation period corresponds to the period of use of the asset and varies according to the asset. For example, furniture can be depreciated over a period of 10 years while computer equipment can only be depreciated over 3 years.

Depreciable items

The condition for the depreciation of an asset is that it is used by the company for its activity in a durable way. This differentiates fixed assets from inventories, which are only temporary. For example, the buildings of a property dealer are not depreciable, nor are the cars owned by a dealer or manufacturer, as they are accounted for as inventory.

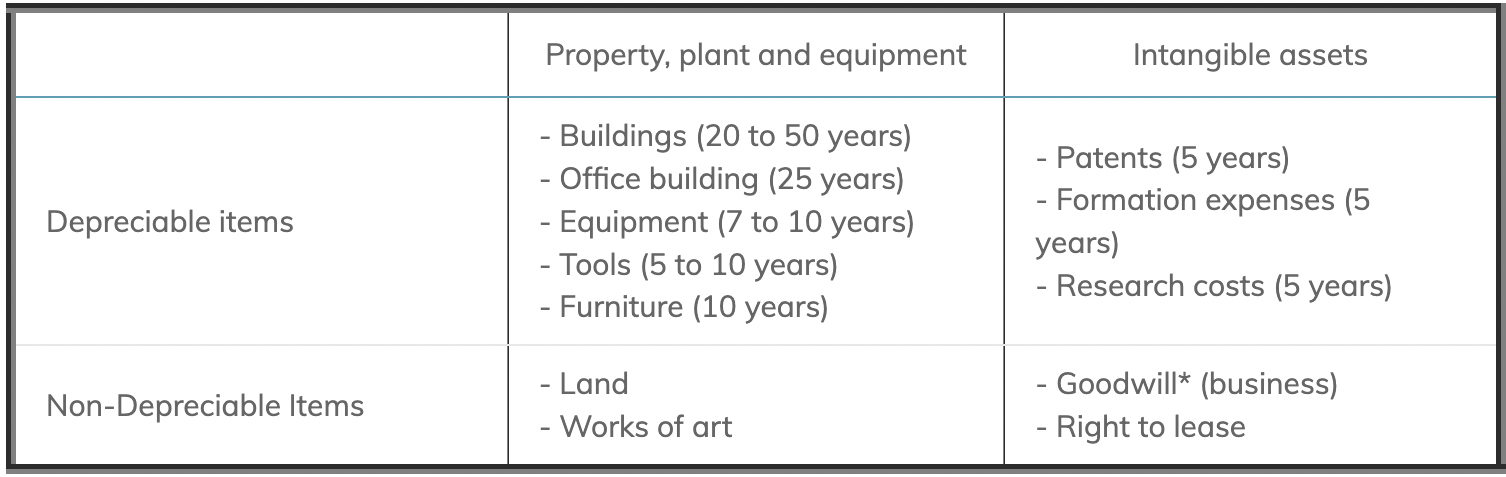

Depreciable items are therefore all the tangible items that make up the assets of a company (buildings, furniture, equipment, tools, etc.). Their depreciation constitutes a real loss for the company and must therefore be deducted from the taxable result.

It should be noted that intangible assets can also be amortized if they are clearly identifiable and provide future economic benefits, for example software, trademarks and patents.

*The 2022 Finance Act created a temporary goodwill amortization scheme for those acquired on or after January 1, 2022 and until December 31, 2025.

The amortization method

The company can use several depreciation techniques:

-

Straight-line depreciation, which is the common law method, allows the same amount to be deducted each year because the annuity is at a constant rate. The deduction is made from the moment the asset is put into service.

-

The degressive depreciation allows a faster depreciation than in linear because it allows to practice more important depreciation annuities the first years, the objective is to support the investment of companies.

This is an optional method which results from a management decision for the director and which only applies to industrial or commercial companies subject to the real taxation system. Moreover, it is reserved for new assets with a useful life of at least 3 years, such as equipment and tools (CGI. Art 39 A).

-

Exceptional depreciation was introduced to encourage the development of certain investments. It is a purely fiscal optional regime which allows the company to allow a significant deduction on a fixed asset (short duration 12/24 months depending on the investment).

From a tax point of view, article 39 B of the CGI obliges companies to recognize a minimum depreciation annually. In contribution with the work of the chartered accountant, the tax lawyer can advise you if you encounter difficulties in this field. So do not hesitate to contact the team of AlterTax Avocats.

Similar articles

VAT: towards the end of reduced rates?

Faced with inflation, the energy crisis and environmental challenges, there is a strong temptation to implement general or targeted VAT cuts. However, in its report on VAT, the Conseil des prélèvements obligatoires (CPO) points out that these reduced rates are costly for public finances, economically inefficient and rarely evaluated. Explanations.

Tax rescripts

It is often important to know in advance the position of the tax authorities on a factual situation presented to them, but also, more specifically, on the interpretation of a tax text or measure on which they have no position.

In this sense, a tax rescript is a response from the tax authorities to a question from the taxpayer concerning the interpretation of a tax provision in force, or a factual situation with regard to tax law.