Real estate capital gains for individuals

Free translation – for information purposes only

The real estate capital gain is the difference between the sale price and the purchase price (or the value declared in the deed of gift or inheritance). Before deciding to sell a property, it is best to know what happens to the capital gain realized.

Determining the taxable gain

Capital gains on real estate are subject to income tax (at a rate of 19% plus a surtax for large capital gains) and social security contributions (17.2% reduced to 7.5% for non-residents established and subject to a social security system in another country of the European Economic Area) when they are realized on the sale of real estate (whether built or not) or a right relating to real estate (usufruct, bare ownership) for a consideration.

The tax treatment of capital gains on real estate results from articles 150U and following of the General Tax Code. On the other hand, this regime does not apply to profits derived from an activity presumed to be professional by law and taxable as industrial and commercial profits, such as property dealers or land developers (article 35 of the CGI).

The basis for calculating the real estate capital gain

The capital gain is calculated as the difference between the sale price and the purchase price. Before being taxed, it can be reduced by an allowance for the length of time the property has been held.

Abatements and exemptions

Under certain conditions, capital gains on real estate may be exempt from income tax and social security contributions. This may correspond to the nature of the property sold, the quality of the seller or the nature of the transaction.

When selling the main residence, the taxpayer will be exempted from income tax. This also applies to the sale of a share in an SCI when it was the main residence of the seller.

Retirees with a low income can benefit from an exemption on capital gains on real estate, if the year before the sale, they were not liable for the tax on real estate wealth (IFI) and their income does not exceed a certain threshold.

The same applies to the sale of a secondary residence with a view to acquiring a principal residence (CGI, art 150U, II).

An exemption is also provided for expropriations and the transfer of full ownership for a price less than or equal to 15,000€.

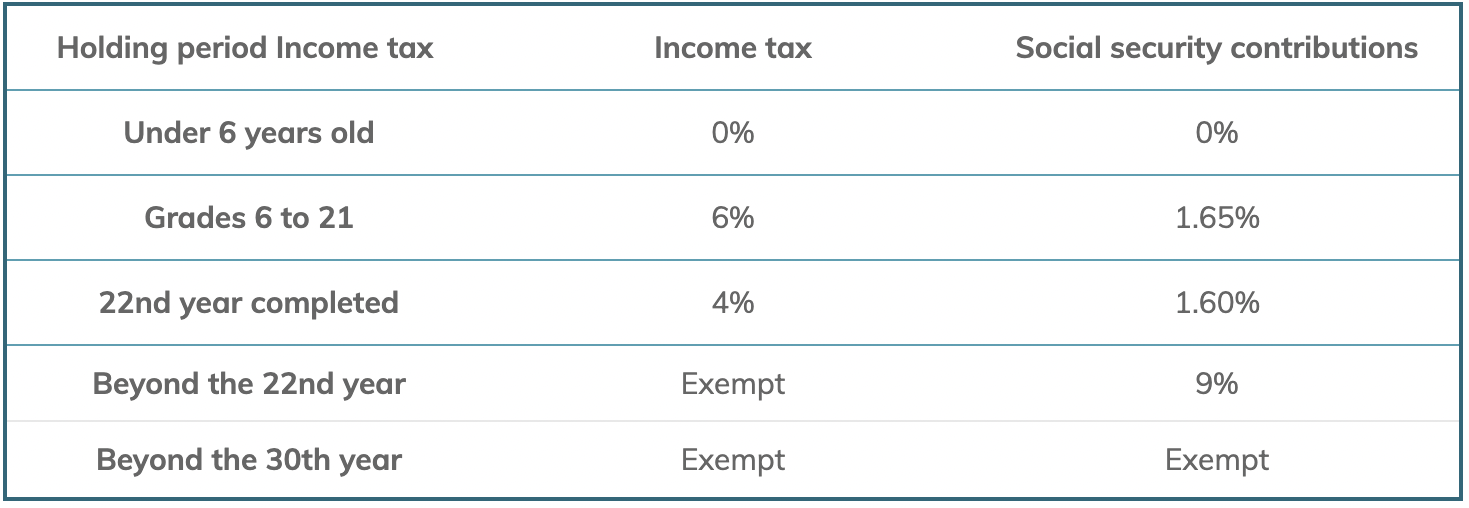

In addition to the exemptions provided for by law, the capital gain realized following a real estate sale may be subject to several deductions for length of ownership (from the 6th year).

Deductions for length of ownership

Capital gains tax rate

The capital gain is taxed at a rate of 19% for income tax and 17.2% (7.5% for nationals of EEA countries subject to a social security system) for social security deductions.

A surtax on capital gains over 50.000€.

Real estate capital gains exceeding 50,000€ are subject to a surtax of 2 to 6% and must be declared separately (art. 1609 nonies G). Whether the capital gain is realized by an individual, a partnership or a non-resident.

Exempted capital gains (principal residence or ownership of more than thirty years) as well as capital gains on the sale of building land or related rights are excluded from the scope of this tax.

Attention: It is important to know that in the absence of an international tax treaty, capital gains on real estate realized by non-residents are subject to a specific levy of 19% or 26.5% depending on the case (CGI, art 244 bis A).

Thus, depending on the situation, it is interesting to anticipate the tax consequences of a transfer of a real estate property, and if necessary to adapt the terms of this transfer according to the patrimonial objectives pursued.

Competent in real estate taxation, the AltertTax Avocats team advises you and provides you with answers to your questions during the transfer of your real estate.

Similar articles

How to determine your tax domicile?

To be subject to income tax in France, individuals must have their tax residence in France.

The notion of tax domicile is independent of civil domicile and nationality. Thus, a French person can be considered as not domiciled in France while a foreigner is.

How to benefit from the research tax credit

The Research Tax Credit, abbreviated CIR, is one of the mechanisms that allow a company to reduce its taxes, and aims to support investment and activities in the field of research and development (R&D). It can benefit young companies as well as older ones. The rate of reduction is not fixed and varies according to the investments made.