The declaration of profits for traders

Individuals who carry out a commercial, industrial or craft activity are taxed under the industrial and commercial profits regime (BIC). They are taxed according to their importance in micro-BIC, or in the real or simplified real regime.

The definition of industrial and commercial profits (BIC)

Industrial and commercial profits are defined by article 34 of the CGI and correspond to the profits of commercial, industrial or artisanal professions (sales of objects and goods, foodstuffs, etc.)

Commercial activities by assimilation are also concerned, such as real estate rental, analysis laboratories, and real estate transactions.

Activities ancillary to business activities are also covered by the BIC regime.

Who is concerned by the industrial and commercial profits (BIC)?

Sole proprietorship (EIRL).

EURL: Single-member company with limited liability (single shareholder).

Partner of a general partnership (SNC), limited partnership (société en commandite simple), economic interest grouping (groupement d’intérêt économique), limited liability company (SARL) under certain conditions.

Determining the tax system

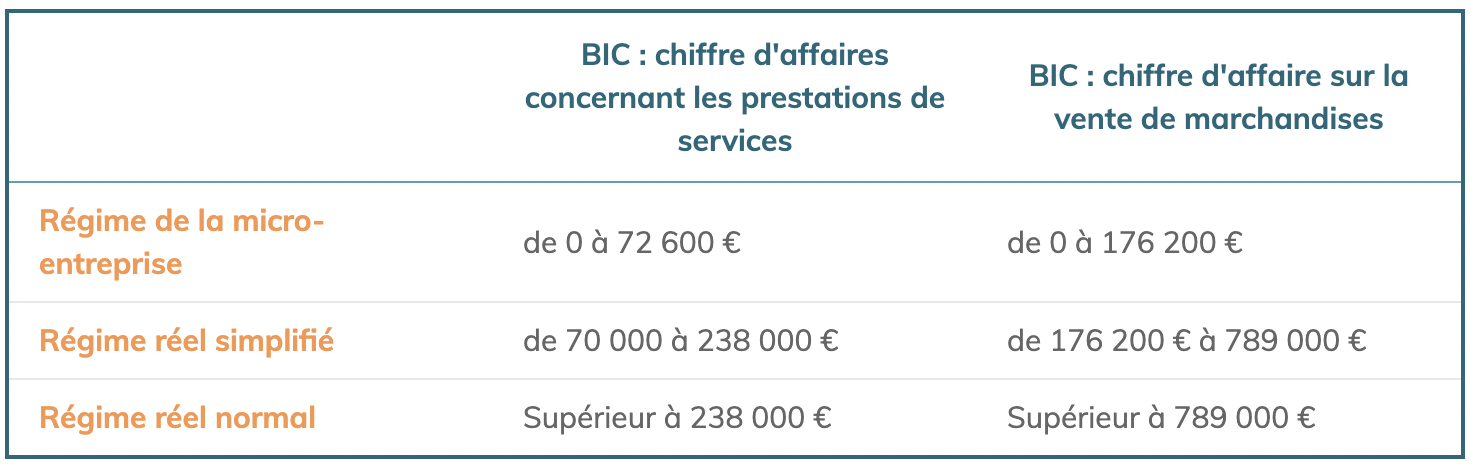

The applicable tax regime depends on the level of annual turnover (gross)

Micro-business regime (micro-BIC)

For micro-enterprises, the taxable profit is calculated from the turnover, from which is subtracted an abatement of 71% of the turnover for purchase/resale activities, 50% of the turnover for service activities, with a minimum abatement of 305 €.

For other companies, the taxable profit is the net profit (gross profit – deductible expenses), to which are added the realized capital gains or losses.

The normal real regime

The normal real regime applies to “big companies” and especially on option, because the annual turnover before tax for sales companies must be higher than 789 000€ and 238 000€ for services. Below these thresholds, companies are subject to the simplified real regime.

The simplified real regime

Between the micro and the normal regime, the “simplified” normal regime allows SMEs, start-ups, to opt for an intermediate regime so that the company that exceeds the thresholds of the micro regime is not subjected to too heavy accounting obligations.

The change in the tax system

There are also several advantages reserved for the companies subjected to the “real” in particular for the company taxable with the micro mode, allowing also the maintenance certain advantages of this mode.

If you are taxed under the micro-enterprise regime and would like to know the procedure and advantages of being subject to the real or simplified real regime, do not hesitate to contact AlterTax avocats.

Similar articles

The declaration of profits for liberal professionals

Liberal professionals (lawyers, doctors, authors, artists, sportsmen…) come under the BNC (non commercial profits) regime of article 92 of the CGI. As such, they are required to file annual profit declarations under the “controlled declaration” regime, unless their profits are less than €72,600 excluding tax, which allows them to benefit from the micro BNC regime (provided that the nature of their activity allows them to opt for this regime).